SIFs, hedge funds and the emerging Indian investor base

The investment universe around the world has undergone tremendous change in the last two decades, and hedge funds (HF) have been at the center of the alternative investment landscape. Hedge Funds (HF) popularity is not just due to the sophistication of the strategies employed but also due to the potential to leverage the intellectual capital of the fund manager to generate differentiated returns. Hedge funds use a broad range of strategies—everything from equity long-short, global macro and distressed debt, through arbitrage and quantitative models—to all having unique risk-return profiles. All this has rendered them vital portfolio building blocks for investors wanting stability in turbulent markets.

Collectively, globally, hedge funds oversee assets of more than USD 5 trillion[1], and estimates indicate this may reach more than USD 13 trillion by 2032[2].

This represents not only investor demand for alternative return sources but also the general understanding that such strategies optimize diversification, reduce drawdowns, and take advantage of inefficiencies between asset classes. Institutional allocators like sovereign wealth funds and pension funds have led this trend, as they aim to combine downside protection with alpha generation.

In India, Category III Alternative Investment Funds, which include hedge funds, have raised commitments worth INR 2,49,182 crores, as of June 30, and made investments worth a total of INR 1,79,479 crores

The Indian context: Investment gaps amid rising affluence

India’s financial markets have progressively deepened, with mutual funds, Portfolio Management Services, and Alternative Investment Funds seeing impressive growth in assets under management. However, even as these products multiplied, a structural deficiency remained. Mutual funds provided diversified but relatively limited exposure, bound by rigorous investment limits. PMS and AIFs, which are positioned on the other end of the spectrum, permitted customized or sophisticated strategies but demanded lofty minimum investments of INR 50 lakh and INR 1 crore respectively

| Year | Mutual Funds AUM (INR Trillion) | AIFs AUM (USD Billion) | Combined PMS + AIF AUM (INR Trillion) | Key Insights |

| 2015 | 11.87 | – | – | Mutual Fund industry at INR 11.87 T — base year for decade growth. |

| 2020 | 26.86 | – | – | MF AUM more than doubled in 5 years. |

| 2023 | – | 101.68 | – | AIF AUM nearly tripled from USD 34.4 B (2019) to USD 101.68 B (2023). |

| 2025(Q1 FY25) | 75.61 | – | 18.87 | MF AUM grew 6× in 10 years; AIF ≈ INR 11.79 T; PMS + AIF ≈ INR 18.87 T total. |

As India’s household wealth increases, a large part of the investors fall in the middle of the pyramid—wealthy but not ultra-high net worth. According to the Allianz Global Wealth Report 2025, household financial assets grew 14.5% in 2024, led by a 28.7% surge in securities, with per capita assets now around INR 2.5 lakh—five times higher than two decades ago[1].

These investors tend to look for access to sophisticated investment products but cannot invest in PMS or AIFs owing to high ticket sizes. As a result, many turned towards unregulated or opaque schemes, putting themselves at risk of governance and compliance. The Securities and Exchange Board of India (SEBI) saw this void and addressed it by creating a new category: Specialized Investment Funds (SIFs).

What are Specialized Investment Funds (SIFs)?

Launched in December 2024 under the amended SEBI (Mutual Fund) Regulations, and operational from February 2025, SIFs reflect an institutional effort at democratizing advanced strategies without losing regulatory control.

The fundamental traits of SIFs are:

- Minimum investment point: Investors can enter with as low as INR 10 lakh—far below PMS or AIF entry levels. Accredited investors are exempt.

- Portfolio construction flexibility: In contrast to mutual funds, SIFs allow for more concentrated portfolios, offering room to create strategies beyond broad diversification.

- Long-short strategies: SIFs unlock the opportunity of long-short investing in equity and debt markets, previously accessible only through Category III AIFs.

- Tailor-made liquidity: SIFs provide several redemption structures—open-ended, closed-ended, or interval—between daily and fortnightly frequency, balancing stability and liquidity.

- Governing regulation: Because SIFs run under the mutual fund regime, investors enjoy disclosure standards, trustee control, and regulatory adherence similar to conventional funds.

Basically, SIFs consolidate the discipline of mutual funds with strategic flexibility of alternatives and thus are bridge products between retail-accommodating and high-net-worth bespoke vehicles.

Where do SIFs fit in India’s investment landscape?

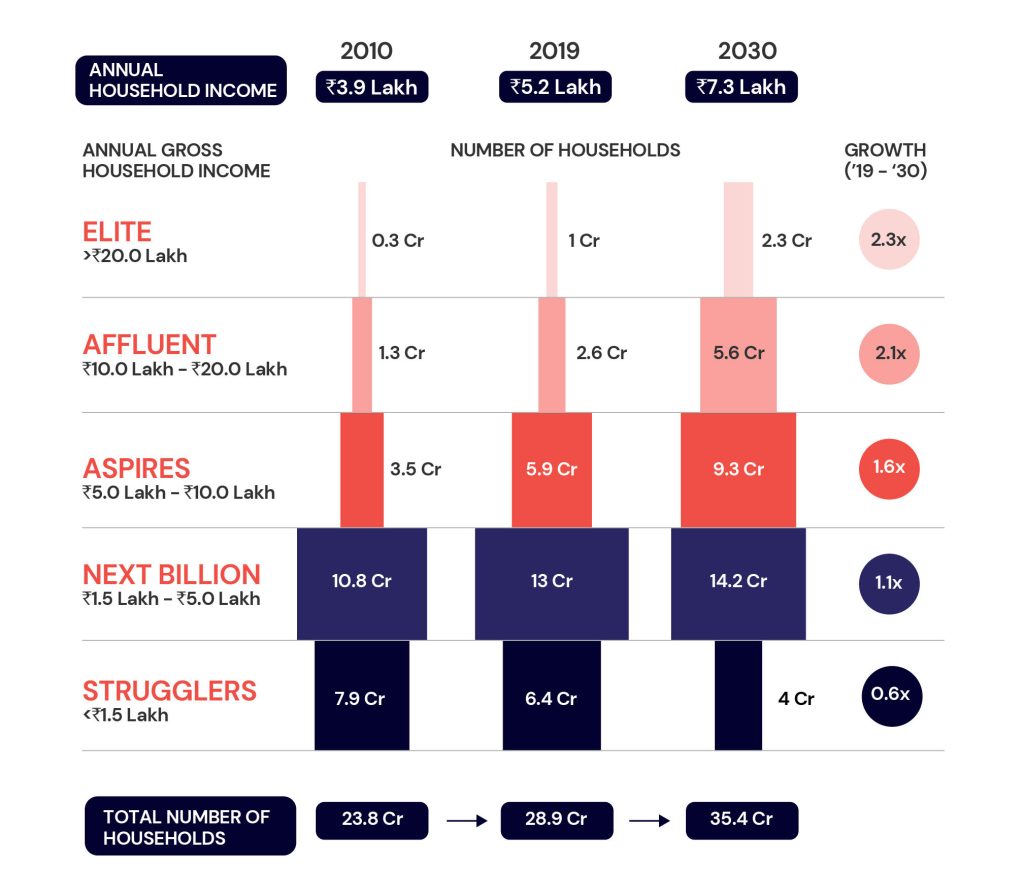

SIFs are conceptually tailor-made for meeting the changing needs of India’s increasingly affluent and aspirational affluent segments. On the basis of income estimates, the number of households with incomes in excess of INR 10 lakh a year is anticipated to nearly double between 2019 and 2030[1]. This segment, comprising tens of millions of families, is the foundation of demand for products sophisticated but affordable.

Exhibit 1 – India’s income pyramid

India’s wealth ecosystem can now be conceptualized as a three-layered pyramid:

- Base layer – Retail investors: Served mostly by mutual funds, systematic investment plans (SIPs), and insurance-linked products.

- Middle layer – Affluent investors: Expanding very fast, this segment is inhibited by PMS/AIF minimum investment requirements but needs more sophisticated products than vanilla MFs.

- Apex layer – Ultra-HNIs and institutions: Targeted by PMS, AIFs, family offices, and global structures.

SIFs are aimed squarely at the middle layer, allowing investors to gain exposure to hedge-fund-like strategies without crossing the INR 50 lakh or INR 1 crore barriers.

Authorized strategies and products within SIFs

SEBI has authorized a series of SIF categories that extend the Indian investor’s choice menu:

- Equity long-short funds – allowing for simultaneous long and short exposures to benefit from both upside and downside opportunities.

- Equity ex-top 100 long-short funds – investing outside the large-cap universe, offering exposure to the dynamics of mid-cap and small-cap stocks.

- Sector rotation long-short funds – theme-driven, concentrated strategies.

- Debt long-short funds – active positioning in fixed income markets, including unhedged derivative holdings.

- Hybrid and active asset allocator funds – dynamically allocating across equity, debt, derivatives, REITs, InVITs, and commodities.

Such a range is deliberately circumscribed to prevent proliferation, with SEBI permitting only a single strategy for each category for an AMC. Derivative exposure limits (up to 25% of NAV, excluding hedging) and issuer concentration caps prevent excessive risk-taking while promoting prudence in innovation

Implications for the wealth management industry

The entry of SIFs is a turning point in India’s investment landscape. Their significance extends across various dimensions:

- Investor inclusion: With reduced entry barrier, SIFs make advanced products accessible to a broader pool of investors.

- Market maturity: Long-short and hybrid techniques align Indian portfolios with international practices, elevating risk-adjusted return paradigms.

- Cannibalization vs coexistence: Overlap with Category III AIFs is possible, but industry sentiments indicate coexistence opportunities. AIFs have universes that are wider, leverage is greater, and structures are tailor-made; SIFs deliver regulated simplicity to new entrants.

- Distribution opportunities: With the lowest transfer price of INR 10 lakh, distributors, wealth managers, and advisory platforms have a new way to connect with clients. However, investor and distributor education is necessary for scale and success given that, currently, only 1,000 individuals have cleared the test certifying potential distributors.

- Regulatory alignment: The structure brings India in line with global markets where structured options for mass affluent investors are standard.

Before investing in SIFs, the following questions should be considered –

- What will the portfolio overlap look like, in comparison with other strategies?

- What should be the benchmark for SIFs and does that solution exist today?

- What are the risks inherent in the strategy?

- What value addition will be adding SIF to your portfolio bring?

Conclusion: Democratization through design

India’s economic rise, as evidenced through a projected GDP of over USD 4 trillion and increasing per-capita incomes, requires an investment structure that is advanced and inclusive in nature. Hedge funds worldwide demonstrate the effectiveness of manager-led strategy in portfolio formation, yet their availability has remained restricted. Through the SIF framework, SEBI has successfully imported hedge fund sophistication into a system that reconciles governance with flexibility.

SIFs are not intended to replace mutual funds, PMS, or AIFs. Instead, they bridge an important gap in the investor needs continuum. providing the increasing number of affluent citizens with a chance to invest in strategies previously reserved for ultra-high-net-worth investors. As track records mature and familiarity increases over time, SIFs can become a pillar of India’s wealth management industry.

By filling the gap between complexity and ease of access, and innovation and regulatory control, SIFs herald a new era in India’s financial growth—where wealth generation is not limited to the select few but meaningfully reaches many.

Disclaimer:

This document is for informational and educational purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy or sell the securities or other investments mentioned in it. Recipients are advised to conduct their own research and seek professional advice before making any investment decisions. The document is prepared on the basis publicly available information, internally developed data and other sources believed to be reliable. All opinions, figures, charts/graphs, estimates and data included in this document are as on date specified therein or as on date and are subject to change without notice. The views provided herein are general in nature and do not consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional advice before investing. This document is intended for the direct recipients only and should not be circulated without prior consent of Nuvama Asset Management Limited (“NAML”). The document is not directed or intended for distribution to or use by any person or entity who is a citizen or resident of or located in locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary views to local law, regulation or which would subject NAML and its affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not eligible for sale in all jurisdiction or certain categories of investors. Persons in whose possession this document are required to inform themselves of and to observe such restrictions. Nuvama Asset Management Limited (“NAML”) , it’s Holding Company, associate concerns or affiliates or any of their respective directors, employees or representatives do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information or any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the information contained in this material. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate, and opinions given are fair and reasonable. NAML is registered with Securities and Exchange Board of India as a Portfolio Manager vide Registration Number INP000007207 and acts as Investment Manager for various AIF schemes with registered office at 801- 804, Wing A, Building No. 3, Inspire BKC, G Block, Bandra Kurla Complex, Bandra East, Mumbai – 400 051. Corporate Identity No: U67190MH2019PLC343440.

0 comments