Demystifying CRE Investing in India – A Closer Look with Nuvama

Commercial real estate (CRE) includes income-generating properties such as offices, retail spaces, warehouses, and industrial parks. It differs from residential real estate not just in function but also in structure. CRE, as an investment avenue, typically offers longer leases, lower vacancy volatility, and higher rental yields.

India’s commercial real estate market is set to double by 2029, with 21% CAGR

India’s commercial real estate market is valued currently at USD 200 billion, with projections to reach a trillion dollars, driven by demand across offices, warehousing, and retail.

Office space dominates the market, contributing 40–45% to the overall market size

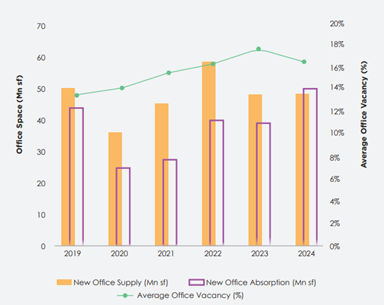

2024 marked a record high for office leasing at 81.7 million sq. ft. (msf), with major contributors of demand being technology firms (42%). Vacancy rates have declined from over 17% in 2021 to around 15% in 2024. India’s office market maintained strong momentum, recording about 42 million sq. ft. (msf) of leasing activity in H1 2025.

India is the global leader in commercial real estate, not only because of its real estate depth but also due to its unmatched pool of skilled manpower which has been a long-term moat. This synergy makes India a dominant destination for global occupiers—especially multinational corporations looking to establish Global Capability Centres (GCCs) and innovation hubs. The combination of workforce scale and modern infrastructure makes India an unparalleled value proposition in the global CRE landscape.

CRE’s importance in portfolios

CRE has always been important in global portfolio construction for its ability to deliver:

- Commercial real estate provides consistent rental cash flows alongside the potential for capital appreciation over time.

- As a physical asset, it has a tangible backing with low correlation to equity, hence offering true diversification.

- Registered Lease agreements with built-in rent hikes help preserve real returns and offset the impact of inflation.

Traditionally, access to quality CRE has been the domain of global institutions and domestic investors have suffered due to lack of access. However, domestic institutional ownership is now being actively encouraged through AIFs, and multiple channels are opening up to enable broader investor participation. From direct investments to fractional ownership models and pooled vehicles such as REITs and AIFs, there are now diverse avenues for Indian investors to be part of this growth story.

Exhibit 1 -Office Space in India (2019-2024) (MN.SFT)

Key growth drivers of CRE led by Office Spaces within India

- Global Capability Centres (GCCs): GCCs now account for ~30% of total office leasing across major cities. This demand will continue to accelerate further as India’s role as a global GCC hub is being solidified India’s role as a global GCC hub is being solidified . With over 1,800 centres currently operational and projections of 2,400 GCCs by 2030, this demand is shaping new office supply and institutional interest.

- Domestic Tenants & MNC Expansion: India’s growing economic influence has not only attracted global corporations but also encouraged domestic companies to expand aggressively. A key trend has been the “flight to quality” — with businesses increasingly opting for Grade-A office spaces that offer modern amenities, wellness features, and ESG compliance.

- Co‑working & Flexible Space Operators: Co-working/flex space leasing reached 13 msf in 2024, up ~30% year-on-year and leased 65 lakh sq ft across seven major cities in H1 CY2025, a 48% YoY , signalling shifting workspace preferences. India’s flexible office space market is projected to expand to 125 million sq. ft by March 2027, up from 80 million sq. ft in December 2024. The demand for flexible spaces has increased rapidly, driven by the need for flexibility, short-term leases, and lower upfront costs for tenants.

The shift toward Grade A+

A defining theme in Indian commercial real estate is the growing shift toward Grade A+ office spaces—high-quality, future-ready assets that meet evolving tenant expectations. These buildings go beyond basic functionality, offering a full suite of features that drive long-term occupancy and value. Grade A+ offices stand out for their ESG compliance, design efficiency, superior maintenance, tech integration, and tenant experience—all of which are increasingly becoming key decision drivers.

In core markets like NCR, Chennai, Bengaluru, Pune, Mumbai, and Hyderabad, these buildings are seeing stronger demand and commanding premium valuations. For investors, they offer greater rental resilience, lower vacancy risk, and more attractive exit opportunities.

The missed opportunity — And the path ahead

India’s commercial real estate market presents a large, addressable, and fundamentally strong opportunity. With relatively stable returns, low volatility, and lower correlation to public equities, CRE stands out as an attractive asset class.

Yet, Indian domestic investors remain underexposed to this segment — missing out on a long-term wealth-building opportunity.

Given India’s global positioning in terms of talent, cost, and infrastructure, CRE is not just a real estate play — it is a nation-building asset class. Platforms like AIFs are democratizing access and enabling greater Indian ownership of India’s commercial growth story.

Harnessing CRE opportunity through AIFs

Alternative Investment Funds (AIFs) are emerging as a vital investment channel for India’s real estate sector, offering ownership of Grade A+ office assets through. Unlike REITs, AIFs follow a growth-oriented approach, entering earlier in the value chain to realise greater value. AIFs allow fund managers to buy higher-quality assets, engage earlier in the value chain, and capture upside through value creation strategies.

AIFs are especially critical in supporting wider domestic ownership in India’s CRE sector. Through AIFs, Indian investors can now access premium office assets and participate in a sector that has historically been dominated by foreign institutional capital. This shift is helping align national wealth creation with national economic assets.

| PRIME Offices Fund — Creating REAL Value in REAL Estate. At Nuvama, the PRIME Offices Fund offers qualified investors access to a curated portfolio of next-generation commercial office assets through a differentiated, institutional-grade AIF platform. Backed by a strategic partnership between Nuvama Asset Management and Cushman & Wakefield, PRIME blends global real estate capabilities with deep on-ground execution to build a resilient and high-quality portfolio. Structured around India’s top six office markets and focused only on Grade A+ “offices of the future”, PRIME targets capital appreciation by investing across new-build and leased assets in high-growth micro-markets. With a target IRR of 20%+, the strategy captures superior entry yields, rental premiums, and lower vacancy rates, while maintaining strong tenant quality and long-term leasing visibility. |

Disclaimer:

Performance related information provided hereunder is not verified by SEBI or any regulatory authority. The performance is based on TWRR. As per SEBI guidelines, returns are net of all expenses and investor returns may differ, based on their period of investment, fee structure and point of capital flows. Please note that performance of your portfolio may vary from that of other investors and that generated by the Investment Approach across all investors because of 1) the timing of inflows and outflows of funds; and 2) differences in the portfolio composition because of restrictions and other constraints. Performance calculated also considers liquid investments and cash. Nuvama Asset Management Limited is registered with Securities and Exchange Board of India as a Portfolio Manager vide Registration Number INP000007207. Securities investments are subject to market risks and there is no assurance or guarantee that the objectives of the Investment Approach will be achieved. Any change in the investment approach may impact the performance of the client’s portfolio. Past performance of the Portfolio Manager/Investment Approach may not be indicative of the performance in the future and no representation or warranty expressed or implied is made regarding future performance. Investors are advised to take independent tax, legal, risk, financial and other professional advice and refer to the Disclosure Document available on the website https://www.nuvama.com/our-businesses/asset-management/ for detailed risk factors/disclaimers. For a detailed disclaimer, please click here. This document is for informational and educational purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy or sell the securities or other investments mentioned in it. Recipients are advised to conduct their own research and seek professional advice before making any investment decisions. The document is prepared on the basis publicly available information, internally developed data and other sources believed to be reliable. All opinions, figures, charts/graphs, estimates and data included in this document are as on date specified therein or as on date and are subject to change without notice. The views provided herein are general in nature and do not consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional advice before investing. Document is intended for the direct recipients only and should not be circulated with consent NAML. The document is not directed or intended for distribution to or use by any person or entity who is a citizen or resident of or located in locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary views to local law, regulation or which would subject NAML and its affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not eligible for sale in all jurisdiction or certain categories of investors. Persons in whose possession this document are required to inform themselves of and to observe such restrictions. Nuvama Asset Management Limited (“NAML”) and Nuvama and Cushman & Wakefield Management Private Limited (“NCWM”), it’s Holding Company, associate concerns or affiliates or any of their respective directors, employees or representatives do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information or any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the information contained in this material. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate, and opinions given are fair and reasonable. NAML is registered with Securities and Exchange Board of India as a Portfolio Manager vide Registration Number INP000007207 and acts as Investment Manage for various AIF schemes with registered office at 801- 804, Wing A, Building No. 3, Inspire BKC, G Block, Bandra Kurla Complex, Bandra East, Mumbai – 400 051. Corporate Identity No: U67190MH2019PLC343440. NCWM is an Investment Manage for Prime Offices Fund (PRIME), which is a scheme of Real Estate Strategies Trust, a trust organized in India and registered with Securities and Exchange Board of India vide registration number IN/AIF2/23-24/1432 Corporate Identity No: U66190MH2023PTC409868

0 comments