Indian Office Space a Strategic Asset Amid Real Estate Boom

Overview of Market Strength

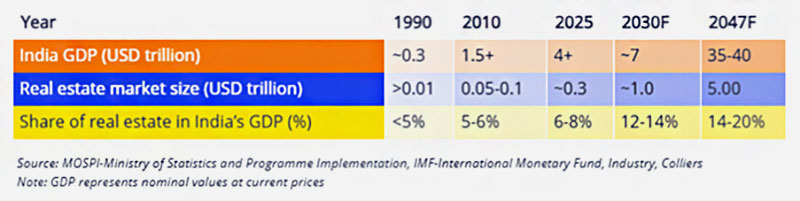

India’s real estate market is projected to grow from ~USD 0.3 tn in 2025 to USD 1 tn by 2030 and USD 5 tn by 2047[1], making it a key pillar of economic growth. Its contribution to GDP will rise from 6–8% in 2025 to 14–20% by 2047[2], driven by urbanization, infrastructure, and policy support.

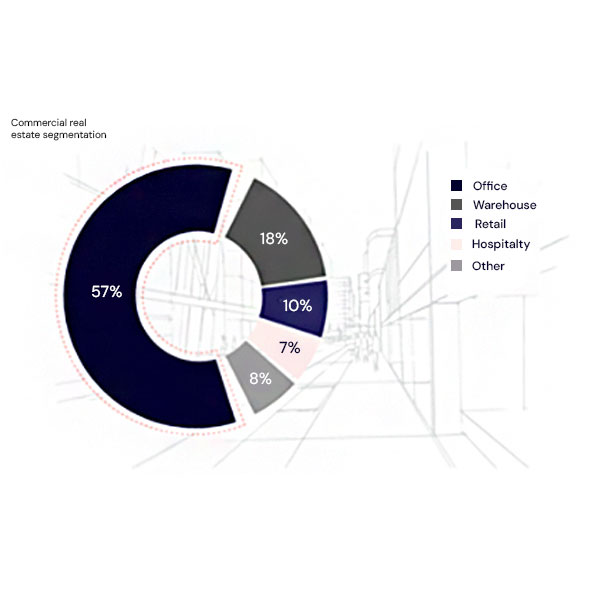

Within the broader growth of India’s real estate sector, commercial real estate (CRE)—particularly the office space segment—continues to attract substantial long-term capital. The sector’s constituents include office spaces, retail, industrial, and logistics properties, with office space making up 57% of the CRE segment[3]. The Indian office market hit a historic peak in gross absorption at 75.2 mn.sq. ft. in 2024[4], continuing to lead office leasing activity across the APAC region. India’s office market capital stock is valued at USD 187 bn[5]. Strong demand from tech occupiers, global capability centers, and evolving work formats has firmly positioned office spaces as a key driver of India’s real estate growth.

The suggested slides are indicative in nature—more slides can be added where necessary.

Services Sector Drives Office Space Demand, with Tech at the Core

India’s service exports grew at an exceptional rate of 12.80% between 2004 and 2024, outpacing major economies like Singapore, China, and the US, and surpassing the global average growth of just 6.56% during the same period. India’s services sector, contributing 55% to GDP in FY2025 with revenues of USD 283 bn, underscores robust and sustained demand for office spaces[6].

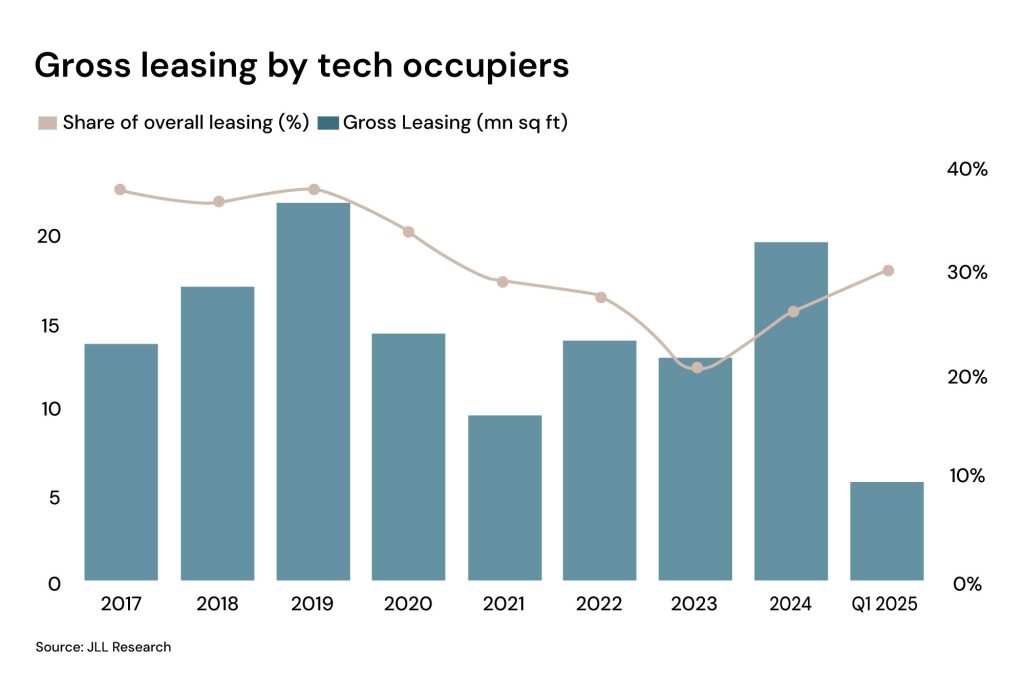

Tech’s Dominance in Office Leasing

The technology sector remains a key driver of office leasing, with over 130.8 mn.sq. ft. leased between 2017 and Q1 2025. Tech accounted for 26% of total leasing in 2024, rising to 30% in Q1 2025[7] and 30.9% in Q2 2025[8]. This growth is largely driven by foreign tech occupiers, primarily through Global Capability Centers (GCCs), who have driven high-volume demand, accounting for 68% of tech-related leasing during this period, with domestic firms making up the remaining 32%[9].

India’s competitive edge : Talent and Cost Efficiency

India’s GCCs employ over 2.1 mn professionals and are supported by a robust talent pipeline of 1.5 mn STEM graduates entering the workforce annually, the country has a deep reservoir of skilled labor. Additionally, the average annual operational cost per employee in a GCC is about USD 25,000[10]—roughly 40–75% lower than in Western economies such as the US and Europe[11]. In FY2025, India’s GCC generated USD 62 bn in net exports[12]. India’s competitive edge lies in its vast talent pool and cost efficiency, ensuring sustained demand for office spaces as multinational tech firms continue to expand in India.

The suggested slides are indicative in nature—more slides can be added where necessary.

India’s Office Market Powered By GCCs Growth and Domestic Demand

GCCs leased 29.2 mn.sq.ft in 2024, a 29% year-on-year increase, with Bengaluru (44%) and Hyderabad (17%)[13] leading the activity and GCCs account for 34% of total office leasing and nearly 40% of office demand growth. In Q2 2025, 7.3 mn.sq.ft. space leased by GCCs accounting for a share of 36%. Notable GCCs in 2025 are Zema Global, Eurobank, Feuji and Morningstar. By 2030, India is expected to host 4,300–4,400 GCCs employing 2.5 – 2.8 mn people[14].

Domestic occupiers, led by flex space and third-party outsourcing firms, leased 8.82 mn.sq.ft., contributing around 45% to the total gross leasing of 19.46 mn.sq.ft. in Q1 2025[15]. Leasing activity by domestic occupiers recorded year-over-year growth across Bengaluru, Hyderabad, Mumbai, and Pune. Flex operators dominated domestic leasing in Bengaluru and Pune, accounting for 70.0% and 61.8% of the space take-up, respectively. In Q2 2025, Chennai observed a significant increase in supply following a period of no new additions. Pune also experienced a substantial rise in supply. Collectively, Pune and Bengaluru constituted over 60% of the total quarterly supply, with Chennai contributing approximately 10%. Grade A spaces are seeing strong demand from the Global Capability Centers (GCCs) and domestic occupiers, presenting a significant opportunity in India’s commercial real estate.

Resilience and Attractive Investment Potential of India’s Office Market

India’s office market has proven resilient, consistently delivering strong performance metrics despite global disruptions. Supported by structural demand drivers, the market continues to offer attractive income-generating potential for investors.

Resilient Recovery & Growing Domestic Occupiers:

After COVID stalled economic activity, leasing activity in India rebounded sharply highlighting the market’s strong resilience. Office leasing continued its strong momentum in Q2 2025, with Gross Leasing Volume (GLV) exceeding 20 mn.sq.ft., for five consecutive quarters from Q2 2024[16]. As of H1 2025, GLV reached approximately 42 mn.sq.ft., putting the market on track to achieve a record 90 mn.sq.ft. by year-end.

The suggested slides are indicative in nature—more slides can be added where necessary.

| Quarter-wise | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 |

| Gross Leasing Volume (mn.sq ft. ) | 21.82 | 24.83 | 23.82 | 20.29 | 21.39 |

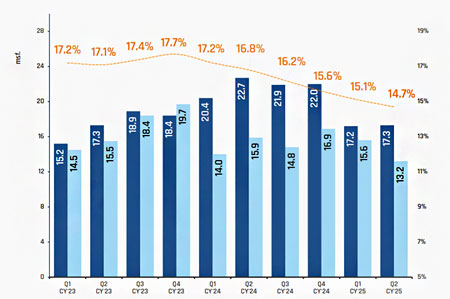

Record Absorption & Declining Vacancy

Between 2024 and 2025, India’s office market vacancy rate fell by 210 basis points, driven by strong demand of 34.5 mn.sq.ft. in H1 2025 and 17.3 mn.sq.ft. in Q2 2025[17], with an average demand-to-supply ratio of 1.3X sustained over the past six quarters. This resilience has been supported by healthy domestic demand, continued expansion of Global Capability Centers (GCCs), and the growing adoption of flexible work models, resulting in robust absorption across Chennai, Bengaluru, MMR, Delhi-NCR, Pune and Hyderabad.

The suggested slides are indicative in nature—more slides can be added where necessary.

Conclusion: India’s Office Market Poised for Durable, Distributed Growth

- India has emerged as a frontrunner in office leasing within the APAC region.

- The country’s commercial real estate sector is bolstered by a vast and cost-efficient talent pool, which consistently drives multinational expansion.

- Demand from both Global GCCs and domestic tenants fuels the supply of Grade A spaces.

- India is positioned as the ‘Office to the World’, supported by long-term sustainable moats, a skilled workforce, and affordable, high-quality real estate

These combined factors establish India’s commercial real estate as a resilient, high-growth investment opportunity, promising strong long-term returns.

Source:

1.&2. https://www.colliers.com/download-article?itemId=7b0b3cd2-47d0-4321-9eb0-f4e4d71ecf70

3. Prime Offices Fund (PRIME), C&W Research

4. https://www.constructionweekonline.in/business/savills-india-reports-unprecedented-absorption-of-75-2-mn-sq-ft-in-office-market-in-2024#:~:text=Despite%20this%20surge%20in%20demand,research%20&%20consulting%2C%20Savills%20India

6. https://www.axismf.com/cms/sites/default/files/pdf-factsheets/SERVICES%20SECTOR%20REPORT.pdf

7. https://www.jll.com/en-in/insights/indias-tech-ecosystem

8. https://www.jll.com/en-in/insights/market-dynamics/india-office

9. https://www.jll.com/en-in/insights/indias-tech-ecosystem

11. https://inductusgcc.com/wp-content/uploads/2024/12/Annual-Report-2024-A-GCC-Compendium-.pdf

12. https://www.dnb.co.in/files/reports/Economic-Impact-of-Global-Capability-Centers.pdf

14. https://media.zinnov.com/wp-content/uploads/2025/03/gcc-talent-trends-2025.pdf

15. https://www.jll.com/en-in/newsroom/indias-q1-office-leasing-hits-1946m-sq-ft-domestic-share-rises

16. https://www.cushmanwakefield.com/en/india/insights/india-office-market-report

17. https://www.fortuneindia.com/business-news/indias-office-market-sees-robust-demand-of-345-mn-sq-ft-in-h1-cy25-vacancy-dips-210-bps-on-strong-absorption/126049

Disclaimer:

This document is for informational and educational purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy or sell the securities or other investments mentioned in it. Recipients are advised to conduct their own research and seek professional advice before making any investment decisions. The document is prepared on the basis publicly available information, internally developed data and other sources believed to be reliable. All opinions, figures, charts/graphs, estimates and data included in this document are as on date specified therein or as on date and are subject to change without notice. The views provided herein are general in nature and do not consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional advice before investing. This document is intended for the direct recipients only and should not be circulated without prior consent of Nuvama Asset Management Limited (“NAML”) and Nuvama and Cushman & Wakefield Management Private Limited (“NCWM”). The document is not directed or intended for distribution to or use by any person or entity who is a citizen or resident of or located in locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary views to local law, regulation or which would subject NAML and its affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not eligible for sale in all jurisdiction or certain categories of investors. Persons in whose possession this document are required to inform themselves of and to observe such restrictions. Nuvama Asset Management Limited (“NAML”) and Nuvama and Cushman & Wakefield Management Private Limited (“NCWM”), it’s Holding Company, associate concerns or affiliates or any of their respective directors, employees or representatives do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information or any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the information contained in this material. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate, and opinions given are fair and reasonable. NAML is registered with Securities and Exchange Board of India as a Portfolio Manager vide Registration Number INP000007207 and acts as Investment Manager for various AIF schemes with registered office at 801- 804, Wing A, Building No. 3, Inspire BKC, G Block, Bandra Kurla Complex, Bandra East, Mumbai–400 051. Corporate Identity No: U67190MH2019PLC343440. NCWM is an Investment Manager for Prime Offices Fund (PRIME), which is a scheme of Real Estate Strategies Trust, a trust organized in India and registered with Securities and Exchange Board of India vide registration number IN/AIF2/23-24/1432 Corporate Identity No: U66190MH2023PTC409868

The suggested slides are indicative in nature—more slides can be added where necessary.

0 comments