Offshore Funds and the Emerging Global Interest in GIFT City

With the growing interconnectivity on a global scale, offshore funds have become more prominent as investment seekers look for diversification outside domestic markets. Offshore funds, or international funds, allow Indian investors to invest in equities, bonds, and fixed income securities of foreign markets. Regulated by SEBI and RBI rules, offshore funds demand strict compliance regarding the credentials of fund managers, custodianship, and jurisdictional clarity.

Generally resident in tax-efficient jurisdictions, offshore funds are suitable for investors seeking long-term objectives, international diversification, and expert fund management. They also provide access to the world’s best businesses and territories, facilitating wealth generation outside of domestic boundaries

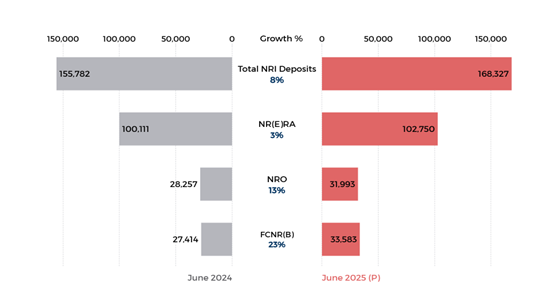

The Indian diaspora—around 35 million in number, 16 million of whom are NRIs (Non-Resident Indians) and 20 million PIOs (People of Indian Origin)—is the prime mover of this trend. NRIs, with double attachment to India and international exposure, have become sophisticated allocators of capital. Their investments are shifting from emotional to rational, facilitated through avenues such as NRE, NRO, and FCNR(B) accounts. In June 2025, NRI deposits increased 8% YoY, with FCNR deposits rising by 23%. In June 2025, NRI deposits increased 8% YoY, with FCNR deposits rising by 23%, marking their enthusiasm to hedge currency risk while keeping the umbilical cord with India intact.

Exhibit 1 – Non-Resident Deposit Outstanding (US $ Mn)

In addition, offshore funds allow Indian investors to hedge against domestic market cycles, geopolitical threats, and currency devaluation. As digitization increases and global assets become accessible, the barriers to entry that previously inhibited offshore participation have decreased considerably. Now, investors can tap into global innovation, technology, healthcare, and clean energy themes—segments that are frequently under-represented in Indian indices.

GIFT City: India’s strategic gateway for global capital

India’s GIFT City (Gujarat International Finance Tec-City) has become a revolutionary platform facilitating global capital flows into India through an onshore but globally integrated framework. SEBI’s nod for FPIs in GIFT to raise up to 100% NRI contributions has triggered offshore fund activity within the IFSC.

The figures do the talking Just in 2024, around 5,000 NRIs invested over INR 13,000 crore in banking products and more than INR 60,000 crore in investment schemes in GIFT. The ecosystem allows investments in mutual fund units, global equities, bonds, and AIFs (Alternative Investment Funds) with beneficial tax treatments and hassle-free repatriation.

For fund managers, this is the chance to access an expanding base of NRIs without the risk of regulatory obstacles of offshore locations such as Singapore or Mauritius. Reportedly, more than 65% of interviewed NRIs place India at the top of their wealth spread over the ten years ahead. GIFT City responds to that demand with tax-neutral vehicles, single-window approvals, and regulation by the consolidated IFSC(international Financial Services Centre) Authority – acting as India’s response to a global fund domicile.

Being an innovation-driven ecosystem, GIFT City also offers operational efficiency. Facility to set up funds conveniently, access to world-class infrastructure, and proximity to a high-quality talent pool has resulted in a significant increase in the interest of Indian as well as overseas fund houses. Even more importantly, the regulatory flexibility of GIFT allows newer structures and asset classes to be introduced seamlessly, keeping pace with global financial innovation.

NRIs: Drivers of India’s offshore investment boom

NRIs represent a heterogeneous group ranging from wage earners in the GCC to second-generation HNIs in developed countries. India was the largest global remittance receiver at USD 129 billion in 2024. Personal transfer receipts, mainly representing remittances by Indians employed overseas, rose to US$ 33.2 billion in Q1FY26 from US$ 28.6 billion in Q1FY25. Segmentation of the wealth in this group dictates investment behavior, ranging from gold-based products to comprehensive wealth management solutions for HNIs.

More and more mass affluent NRIs are looking for tax-efficient, India-focused, and globally diversified products. Further, most NRIs are shifting from remittances to strategically chosen investment vehicles that cut across geographies. Their portfolios differ considerably based on their place of residence, economic objectives, and business relationships with India. For example, NRIs with businesses in India typically invest as much as70% of their portfolio in Indian assets.

With the appropriate combination of product complexity and jurisdictional simplicity, Indian asset managers can now provide custom solutions via GIFT City. These encompass AIFs, mutual funds, and ETFs addressing wealth creation, preservation, and succession planning. With increasing financial awareness among second-generation NRIs, the demand for structured, risk-adjusted returns keeps widening. In addition, as NRIs age financially and their ambitions shift, they look for exposure not only to known Indian industries like real estate or gold but also to scalable businesses in fintech, healthcare, and renewables. These tastes are compelling fund managers to construct hybrid global portfolios that blend Indian exposure with global opportunities. GIFT City is the ideal vehicle to organize these two-pronged investment structures, providing governance, flexibility, and innovation.

Global tailwinds and the strategic case for India

As the global flows of capital shift away from developed economies towards emerging markets, India has emerged as a leading choice. Geopolitical tensions, decoupling from China economically, and buoyant macroeconomic fundamentals have put India in the right position. In contrast with peers, India provides superior growth prospects, prudent governance, and enhanced liquidity.

Demographic strength and consumption potential of India are major drivers underpinning India’s increasing attractiveness. With a young and rapidly growing population, the local demand base provides a solid foundation for profitability of corporate India. This, in turn, underpins the investment case for offshore funds investing in Indian growth.

Investing without borders

As volatility goes structural and relative return strategies falter, offshore funds rooted in India’s GIFT City offer a resilient alternative. For NRIs and foreign investors alike, the intersection of regulatory reform, market opportunity, and geopolitical alignment is forging an investment destination at once aspirational and rooted. GIFT City is now not a peripheral notion—it is the hub of India’s global investment aspiration.

The future of capital is boundaryless. And for India, it starts at GIFT. Registered in GIFT City and consistently among India’s leading funds over the past four years, the Nuvama India EDGE Fund stands as a strong avenue for investors

Disclaimer:

Performance related information provided hereunder is not verified by SEBI or any regulatory authority. The performance is based on TWRR. As per SEBI guidelines, returns are net of all expenses and investor returns may differ, based on their period of investment, fee structure and point of capital flows. Please note that performance of your portfolio may vary from that of other investors and that generated by the Investment Approach across all investors because of 1) the timing of inflows and outflows of funds; and 2) differences in the portfolio composition because of restrictions and other constraints. Performance calculated also considers liquid investments and cash. Nuvama Asset Management Limited is registered with Securities and Exchange Board of India as a Portfolio Manager vide Registration Number INP000007207. Securities investments are subject to market risks and there is no assurance or guarantee that the objectives of the Investment Approach will be achieved. Any change in the investment approach may impact the performance of the client’s portfolio. Past performance of the Portfolio Manager/Investment Approach may not be indicative of the performance in the future and no representation or warranty expressed or implied is made regarding future performance. Investors are advised to take independent tax, legal, risk, financial and other professional advice and refer to the Disclosure Document available on the website https://www.nuvama.com/our-businesses/asset-management/ for detailed risk factors/disclaimers. For a detailed disclaimer, please click here. This document is for informational and educational purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy or sell the securities or other investments mentioned in it. Recipients are advised to conduct their own research and seek professional advice before making any investment decisions. The document is prepared on the basis publicly available information, internally developed data and other sources believed to be reliable. All opinions, figures, charts/graphs, estimates and data included in this document are as on date specified therein or as on date and are subject to change without notice. The views provided herein are general in nature and do not consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional advice before investing. Document is intended for the direct recipients only and should not be circulated with consent NAML. The document is not directed or intended for distribution to or use by any person or entity who is a citizen or resident of or located in locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary views to local law, regulation or which would subject NAML and its affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not eligible for sale in all jurisdiction or certain categories of investors. Persons in whose possession this document are required to inform themselves of and to observe such restrictions. Nuvama Asset Management Limited (“NAML”), it’s Holding Company, associate concerns or affiliates or any of their respective directors, employees or representatives do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information or any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the information contained in this material. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate, and opinions given are fair and reasonable. NAML is registered with Securities and Exchange Board of India as a Portfolio Manager vide Registration Number INP000007207 and acts as Investment Manage for various AIF schemes with registered office at 801- 804, Wing A, Building No. 3, Inspire BKC, G Block, Bandra Kurla Complex, Bandra East, Mumbai – 400 051. Corporate Identity No: U67190MH2019PLC343440

0 comments