I] TRANSACTION SYNOPSIS

| IPO Size | ~₹7,400 MN |

| IPO Structure (Primary / OFS) | 50% / 50% |

| Post Issue Dilution | ~39.00% |

| IPO Price | ₹ 65 |

| Total number of applications* | 1,90,997 |

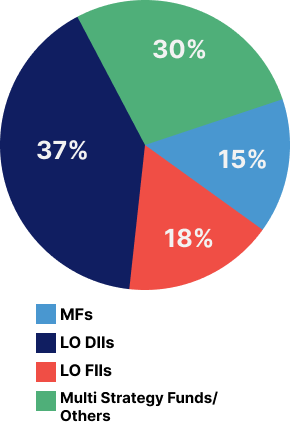

II] SELECT ANCHOR INVESTORS AND ANCHOR BOOK

- ENAM

- ICICI Prudential MF

- HDFC MF

- Birla MF

- MK Ventures

- Edelweiss Crossover

- Driehaus

III] DEAL HIGHLIGHTS

- Inox Green Energy Services Limited, the only pure play wind power O&M service provider within India to go public

- We emerged as the ‘Banker of Choice’, being the only common BRLM for both the IPOs launched by the Inox GFL Group in the last decade, demonstrating our philosophy of “Invested in YOU”

- April 2015 – Inox Wind IPO

- November 2022 – Inox Green IPO

- We navigated the Company through critical regulatory nuances and several intricacies providing complete handholding to management team

*Excluding anchor subscription and after technical rejections