I] TRANSACTION SYNOPSIS

| IPO Size | ~ ₹ 31,500 MN |

| IPO Structure (Primary / OFS) | – / 100% |

| Post Issue Dilution | ~ 15.0% |

| IPO Price | ₹ 866 |

| Subscription (QIB / HNI / Retail)* | 2.9x / 0.8x / 0.2x |

| Total number of applications* | 93,672 |

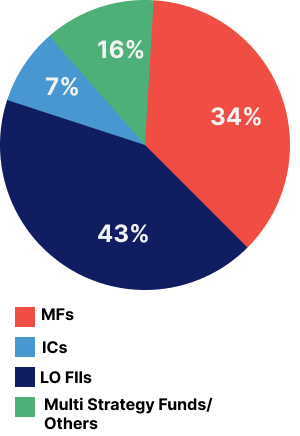

II] SELECT ANCHOR INVESTORS AND ANCHOR BOOK

- Axis MF

- Birla MF + Offshore

- Fidelity

- Govt. of Singapore

- ICICI Prudential MF + Life

- Kotak MF + Life + Offshore

- Nomura

- SBI MF

- Wellington

III] DEAL HIGHLIGHTS

- IPO of largest company in India in the men’s Indian wedding and celebration wear segment^

- Despite market volatility over past 2 weeks and correction of ~6%@, Company listed at a premium of 8.0%#

- We provided end-to-end client handholding and guidance on various deal contours and timing

*Excluding anchor subscription & after technical rejections ; ^ in terms of revenue, OPBDIT and profit after tax for the Financial Year 2020

# NSE Opening Price is considered @ Movement of Nifty 50 between 2 weeks high and low