I] TRANSACTION SYNOPSIS

| IPO Size | ₹ 10,235 mn |

| IPO Structure (Primary / OFS) | 15% / 85% |

| Post Issue Dilution | 29.07% |

| IPO Price | ₹ 662 |

| Subscription (QIB* / HNI / Retail) | 115.5x / 183.2x / 8.9x |

| Total number of applications# | 1,912,663 |

II] SELECT ANCHOR INVESTORS AND ANCHOR BOOK

- ADIA

- Birla MF

- Government of Singapore

- ICIC Prudential MF

- Mirae MF

- Nippon MF

- Stewart Investors

III] DEAL HIGHLIGHTS

- Highest subscribed Healthcare IPO (Ex Pharma)^

- Healthy subscription with more than 19 Lacs applications

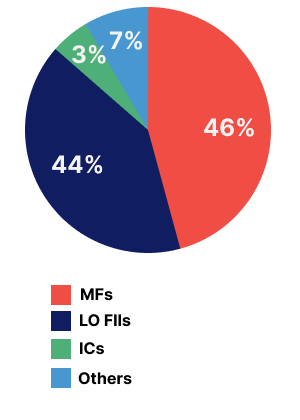

- 100% of anchor book was allocated to LO Investors

- We provided end-to-end client handholding and guidance on various deal contours and timing

*Excluding Anchor

# Before technical rejections

^IPOs since 2010 considered