I] TRANSACTION SYNOPSIS

| IPO Size | ₹ 13,983 mn |

| IPO Structure (Primary / OFS) | 43% / 57% |

| Post Issue Dilution | 14.72% |

| IPO Price | ₹ 796 |

| Subscription (QIB* / HNI / Retail) | 114.0x / 86.3x / 4.2x |

| Total number of applications# | 1,294,261 |

II] SELECT ANCHOR INVESTORS AND ANCHOR BOOK

- ADIA

- BlackRock

- Birla MF

- FMR

- GSAM

- HDFC MF

- MSIM

III] DEAL HIGHLIGHTS

- 2nd largest pharmacy retail chain in India^

- Healthy subscription with more than 12 Lacs applications

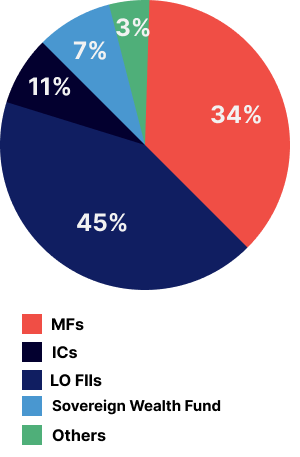

- 100% of anchor book was allocated to LO Investors

- Pre-IPO – Warburg Pincus, one of the selling shareholders sold 6.18% of pre-issue equity capital for ₹ 5,500 mn to marquee investors SBI MF, Malabar and Motilal Oswal MF at IPO Price.

*Excluding Anchor

# Before technical rejections

^ In terms of revenue in Fiscal 2020 and as on March 31, 2021