I] TRANSACTION SYNOPSIS

| IPO Size | ~₹ 15,885 MN |

| IPO Structure (Primary / OFS) | – / 100% |

| Post Issue Dilution | ~11.50% |

| IPO Price | ₹ 474 |

II] SELECT ANCHOR INVESTORS AND ANCHOR BOOK

- Capital Research

- Fidelity

- ENAM

- ADIA

- Norges Bank

- HDFC MF

- WhiteOak

- SBI Life Insurance

- Carmignac Gestion

III] DEAL HIGHLIGHTS

- With Five-Star’s IPO, we have successfully closed all ₹ 15,000 mn+ IPOs of all private lending companies in last 4 years

- We were the only Bank to successfully close 2 Pre-IPO transactions and generate deal momentum – Highest share in the 2 Pre-IPO transactions with a ~76% share out of ~₹ 4,000 mn raised

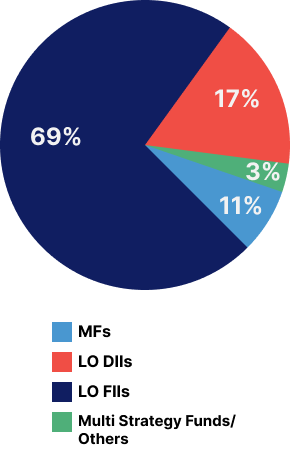

- Spearheaded procurement in the Pre-IPO and Anchor Segment – Highest overall share of ~51% share in terms of amount and Highest number of investors converted (9/19)

- Dominated procurement in the Main Book of the IPO – Procured overall largest QIB Bid & largest MF Bid

- Despite muted subscription and market volatility over past 2 weeks and correction of ~3%@, Five-Star’s IPO saw a steady listing with stock price seeing days high of ~8% and closing at ~5% above opening price^

^NSE Prices are considered; @ Movement of Nifty 50 between 2 weeks high and low