Deal Details & Contribution

- Largest QIP in the Railway Manufacturing Space till date*

- QIP helped Company in achieving various objectives of raising growth capital for funding Company’s CAPEX plans & Working capital requirements as well as Repay Borrowings

- Spearheaded demand mobilization

- Offering received an overwhelming response from investors

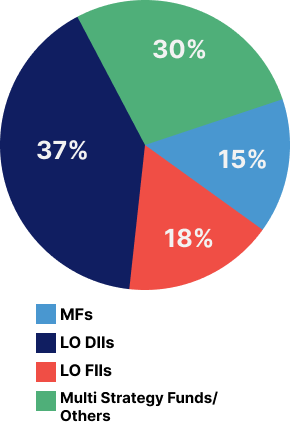

- ~75% of the book was allocated to ‘Long Only’ Investors

- As the left-lead and post issue banker, hand-held the Company with end-to-end execution, swift regulatory approvals, thereby ensuring timely launch and closure

- Nuvama garnered participation from a diverse investor set including Marquee ‘Long Only’ FIIs, Mutual Fund and Family Offices

- Procured 36% of QIP demand in terms of amount in a 3-bank syndicate

Client Testimonial

“Let me take the opportunity to thank the entire Team of Nuvama, who have burnt their mid night oil and put in really a superb effort to make Project Sambhav, really Sambhav. We really appreciate the professionalism shown by your team during the entire fund-raising process. You steered the QIP process on both regulatory as well as marketing front. You were pivotal in leading the discussion with key Domestic Anchor Investors that gave us the confidence to launch the deal. We appreciate your role in making the QIP a huge success”

Deal Highlights:

- Sterling and Wilson# is a global pure-play, end-to-end renewable solar engineering, procurement and construction (EPC) and O&M solutions provider

- Offer was made to comply with minimum public shareholding (MPS) norms

- Despite market volatility over past 2 weeks prior to deal launch and correction of ~3%^, the issue witnessed a healthy response from investors – Non-Retail Category was oversubscribed ~1.5x of the base offer size

Our Contribution:

- We hand-held the Promoters through the entire process including optimal deal construct, pricing & timing of the issue and positioning the company to investors

- This marks our 3rd deal closure in the renewables / power sector within a period of 45 days – Anzen India Energy Trust (InvIT IPO), Inox Green Energy (IPO) and Sterling and Wilson (OFS)

- This was our second deal w.r.t Sterling and Wilson post advising Reliance Group’s acquisition of stake in the Company

*Broking Services provided through an Associate Company

#Sterling and Wilson Renewable Energy Limited (formerly known as Sterling and Wilson Solar Limited)

^Movement of Nifty 50 between 2 weeks high and low

I] TRANSACTION SYNOPSIS

| IPO Size |

~₹7,400 MN |

| IPO Structure (Primary / OFS) |

50% / 50% |

| Post Issue Dilution |

~39.00% |

| IPO Price |

₹ 65 |

| Total number of applications* |

1,90,997 |

II] SELECT ANCHOR INVESTORS AND ANCHOR BOOK

- ENAM

- ICICI Prudential MF

- HDFC MF

- Birla MF

- MK Ventures

- Edelweiss Crossover

- Driehaus

III] DEAL HIGHLIGHTS

- Inox Green Energy Services Limited, the only pure play wind power O&M service provider within India to go public

- We emerged as the ‘Banker of Choice’, being the only common BRLM for both the IPOs launched by the Inox GFL Group in the last decade, demonstrating our philosophy of “Invested in YOU”

- April 2015 – Inox Wind IPO

- November 2022 – Inox Green IPO

- We navigated the Company through critical regulatory nuances and several intricacies providing complete handholding to management team

*Excluding anchor subscription and after technical rejections