Deal Details

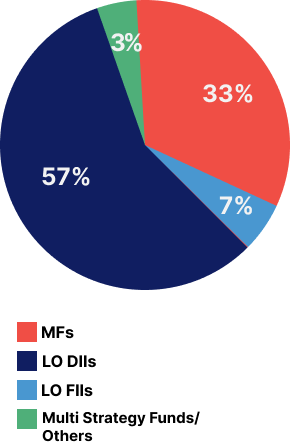

- Despite steep increase in the share price in past 1 year, QIP saw healthy subscription across investor categories

- Deal was strategically launched at an attractive Price with discount of 10.24%^ to closing Price on launch day

Nuvama Contribution

- “Banker of Choice” having handled Highest Sole Mid size QIP deals* on the street

- Garnered interest from large anchor investors including Marquee ‘Long Only’ FII, High pedigree DII Investor and Family Offices

- As Sole BRLM, Nuvama handheld the management through the entire QIP process, providing strategic guidance and regulatory support

About Xpro

Xpro is mainly engaged in the business of polymer processing at multiple locations and is a manufacturer in India of coextruded plastic films, thermoformed components, coextruded cast films and speciality films (including dielectric films and special purpose biaxilliary oriented polypropylene (“BOPP”) Films)

I] TRANSACTION SYNOPSIS

| IPO Size |

~₹ 5,000 MN |

| IPO Structure (Primary / OFS) |

80% / 20% |

| Post Issue Dilution |

~24.97% |

| IPO Price |

₹ 207 |

| Subscription (QIB / HNI / Retail)* |

90.9x / 46.1x / 63.7x |

| Total number of applications* |

17,92,850 |

II] SELECT ANCHOR INVESTORS AND ANCHOR BOOK

- ENAM

- Factorial

- HDFC MF

- Millennium

- Motilal Oswal MF + AIF

- MK Ventures

- Theleme Partners

III] DEAL HIGHLIGHTS

- DCX Systems Ltd, a preferred Indian Offset Partner for foreign OEMs for executing aerospace and defence manufacturing projects

- 3rd highest subscribed IPO in CY2022 – Strong subscriptions across investor pools

- Company listed at a premium of 38%^

- Advised the Promoter in Pre-IPO stake Sale

- We was the left-lead banker to the issue and hand-held the management to ensure quick closure within 10 months from kick-off

For further details, please refer to: www.edelweissfin.com

*Excluding anchor subscription & after technical rejections

^NSE Opening Price is considered